By Anuoluwapo Agboke, Media & Corporate Communications, AAA Chambers

INTRODUCTION

Globalisation which was once a tool for colonisation has metamorphosed over the years into what we recognise today as foreign investment. There comes a time in every business where the need to expand beyond the shores of one’s country is imminent. At one point or the other, every individual is a foreigner. The term ‘foreigner’ or ‘alien’ refers to a person who is neither a citizen or national of the State in which such a person resides. In business terms, a foreigner could be a foreign natural person or legal person, where natural persons refer to individuals and legal persons refer to companies. Therefore, any person not of Nigerian citizenship is a foreigner and a Nigerian registered company not solely owned by citizens of Nigeria is regarded as an ‘alien’ corporation.

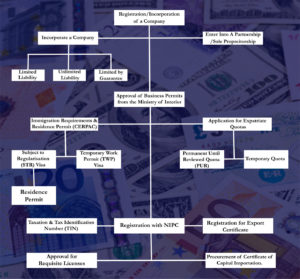

GUIDE TO STARTING A BUSINESS AS A FOREIGNER IN NIGERIA

- Registration/Incorporation of a company

- Approval for business permits from the Ministry of Interior

- Immigration Requirements and Residence Permit (CERPAC)

- Application for Expatriate Quotas

- Registration with Nigerian Investment Promotion Commission (NIPC)

- Taxation & Tax Identification Number (TIN),

- Registration for Export Certificate

- Approval for requisite licenses

REGISTRATION/INCORPORATION OF A COMPANY

Firstly, it is pertinent to note that before a person or entity can commence business in Nigeria, such person (entity) must be recognized by the Nigerian law, which is the registration of the company. This leads us to the factors a foreigner must consider, first of which is the type of company that is intended to be established. In Nigeria, a foreigner can either;

- Incorporate a company

- Enter into partnership or

- Establish a sole proprietorship

1.1 Incorporate a Company

It is pertinent to note that any foreigner or foreign company intending to do business in Nigeria must first ensure that its company is duly incorporated as a separate entity in Nigeria, otherwise, such a foreigner cannot carry on Business in Nigeria (Section 54 of the Companies and Allied Matters Act, CAP C20Law of the Federation of Nigeria 2004, further referred to as CAMA). Below are the types of companies;

- Limited Liability Company (Company Limited by Shares)

- Unlimited Liability Company

- Limited by Guarantee

Limited Liability Company

A limited liability company is where the liability of the shareholders to the creditors is limited to the capital invested in the company. A limited liability company can be a private ( minimum of 2 and a maximum of 50 members) or public company (minimum of 2 and an unlimited number of members).

Unlimited Company

An unlimited company can be incorporated with or without share capital, however, the liabilities of its members is unlimited.

Company Limited by Guarantee

In simple terms, a company limited by guarantee is a non-profit company and the members’ liability will be summed up to the amount undertaken by such members.

Procedural Steps for Incorporation of a Company in Nigeria

The Corporate Affairs Commission (CAC) is charged with the incorporation of companies at a prescribed fee and the procedure is as follows:

- Check for availability and reservation of name

- Submission of Relevant Documents for Incorporation such as;

- Approved Availability and Reservation of Name form (CAC1.1)

- Particulars of persons who are to be first directors

- Return of allotments

- Statement of authorised share capital

- Notice of address of registered office of the company

Note: PO Box address and private bag address are not acceptable.

- Statutory declaration of compliance by a legal practitioner certifying the compliance of registration requirements.

- Duly stamped Memorandum of Articles of Association.

- Professional certificates depending on the nature of business

- Copies of a valid residence permit, if the expatriate directors are resident in Nigeria.

3. Upon payment of all allotted fees, a Certificate of Incorporation is issued.

A Certificate of Incorporation is a prima facie evidence that all requirements for registration/incorporation of the company have been met and the company has been duly registered. It is important to note that registration of the company usually does not exceed 10 days.

1.2 Enter Into A Partnership/Sole Proprietorship

A partnership is an arrangement where two or more people congregate to form a company. Partnerships may be limited, that is where a partner’s liability is limited to the value of capital contributed as at the time of entering into the partnership, or general partnerships, where like sole proprietorships, the liability is unlimited.

Being the simplest form of business, a sole proprietorship is owned by one person of which he/she is responsible for the debts of the business with unlimited liability. Below are the requirements for registering a partnership or sole proprietorship as provided for in Section 573(1)(a)(b) of CAMA.

- Check for availability and reservation of name

- Submission of relevant documents

- Approved Availability and Reservation of Name form

- Duly completed business name registration form stating the following:

- Business name

- General nature of business

- Full postal address of the principal place of business and other business locations,

- The present forenames and surnames and any former forenames and surnames of each partner or individual as the case may be, inclusive of nationality, gender, age and usual residence.

- Two (2) passport size photographs of the investor if it is an individual or two (2) passport size photographs of each partner.

- Copies of residence permit

- Upon payment of all prescribed fees, the registration will be done and a certificate of registration will be issued.

Name Restrictions.

It is pertinent to state that not all business names are available for registration. Under certain laws, there are restrictions guiding the choice of a business name. These restrictions are provided for in Section 30 (1)(2) of CAMA and it states that no company shall be registered under this act if:

- The name of the company is identical to an already existing and registered company or closely alike with the name so as to be calculated to deceive. A new company can only be registered where the already existing company is in the process of dissolution and signifies its consent in such manner as the Commission requires; or;

- The business name contains the words “Chamber of Commerce” unless it is a company limited by guarantee; or

- It is in the opinion of the Commission that the company is capable of misleading as to nature, the extent of its activities or is undesirable, offensive or otherwise contrary to public policy; or

- It is in the opinion of the Commission that the company would violate any existing trademark or business name registered in Nigeria unless the consent of the owner of the trademark or business name has been obtained.

Except with the consent of the Commission, no company shall be registered by a name which:

- Includes the word “Federal”, “National’, “Regional”, “State”, “Government”, or any other word which in the opinion of the Commission suggests or is calculated to suggest that it enjoys the patronage of the Government of the Federation or the Government of a State in Nigeria, as the case may be, or any Ministry or Department of Government

- Contains the word “Municipal” or “Chartered” or in the opinion of the Commission suggests, or is calculated to suggest, connection with any municipality or other local authority; or

- Contains the word “Co-operative” or the words “Building Society”; or

- Contains the word “Group” or “Holding”.

Exemption of Registration of Foreign Companies

A foreign company may apply to the National Council of Ministers to be exempted from registration on the following grounds. (Section 56 CAMA)

- The foreign company is a company invited to Nigeria by or with the approval of the Federal Government to execute any specified individual project.

- If it is a foreign company present in Nigeria for the execution of specific individual loan projects on behalf of a donor country or international organization.

- The company is a foreign government-owned company engaged solely in export promotion activities; and

- Engineering consultants and technical experts engaged in any individual specialist project under contract, with any of the governments or government bodies in the Federation or with any other body or person, of which the contract has been approved by the Federal Government.

For instance, health needs agenda requiring Easy Shelter Limited, a foreign company into the manufacturing of tents and other shelter materials to be distributed to internally displaced persons in Borno, Nigeria, contracted by the World Health Organisation (WHO) may be exempted from registration in Nigeria. Another instance includes foreign companies such as construction companies invited to build roads, hospitals and other infrastructure may be exempted from registration.

Steps to Applying for Exemption.

The application for exemption must be in writing and must be addressed to the Secretary to the Government of the Federation Government (SGF) of Nigeria, setting out a list of particulars by virtue of Section 56(2) CAMA, after which, the application for exception will be received and considered by the Government. If deemed expedient in the circumstances, the application may be granted specifying the period and/or project for which it is granted.

If necessary, any exemption granted may be revoked by the Government of which both the grant of exemption and any revocation must be published in the Gazette. Any company granted an exemption assumes the form of an unregistered company and must submit a report in the prescribed form to the Corporate Affairs Commission (CAC) annually

Conditions for the Revocation of Exemption

The exemption granted to a foreign company may be revoked if it is of the opinion of the National Council of Ministers that the company has breached any provision of the law, the company has failed to fulfil any condition contained in the exemption order or for any other good or sufficient reason.

APPROVAL FOR BUSINESS PERMITS FROM MINISTRY OF INTERIOR

Operating a business in Nigeria requires an approval for business permits from the Ministry of Interior and as Section 8 (1)(a)(b) of the Immigration Act CAP I1 Laws of the Federation of Nigeria 2004 states, no person other than a citizen of Nigeria is permitted to establish, take over any trade or business, register or take over any company with limited liability without the written consent of the Minister of Interior. This is an operational permanent permit for the local operation of a business with expatriate investment either as a branch or subsidiary of a foreign company or otherwise.

IMMIGRATION REQUIREMENTS AND RESIDENCE PERMIT (CERPAC)

Generally, any person who intends to stay in Nigeria for a long period of time will require a residence permit. Such a permit allows an expatriate to live and work in Nigeria on a long term basis and in order to be considered, such persons must obtain employment with a company that has expatriate quota positions. However, individuals wishing to enter the country must procure the appropriate visa to suit their purpose. The Nigerian Visa categories are as follows;

Categories of Visa

- Visa-on-Arrival

- Transit Visa

- Business Visa

- Temporary Work Permit (TWP)

- Subject to Regularisation (STR) Visa

- Diplomatic Visa

A foreigner with intentions to live and work in Nigeria for a long period of time is required to come into the country with a Subject to Regularisation (STR) Visa. The application for this visa type must be made by the employer company, to the Nigerian Embassy or Consular office in the prospective employee’s country of residence. The validity of the STR Visa is 90 days during which an application will be made to the Comptroller General of Immigration (CGI) for regularisation of the employee’s stay. Prior to the expiration of the STR visa, the employer is required to apply to the CGI requesting the regularisation of the Combined Expatriate Residence Permit and Aliens Card (CERPAC). Below are the general requirements for an STR Visa;

- Letter of Application for Regularisation of Stay and acceptance of Immigration Responsibilities by the employer / School / Embassies / High Commission / International Organizations / INGOs / NGOs / MDAs (for Government officials)

- Passport bio-data page of the expatriate

- Copy of the STR visa page and arrival endorsement page

- Form IMM 22 (Visa Application Form)

- 2 recent passport photographs

- Expatriate’s valid National Passport

- Evidence of purchase of CERPAC Form (Bank teller)

Fresh applications are to be submitted to the Office of the Comptroller General, Nigeria Immigration Service Headquarters Abuja or to the Office of the Comptroller of Immigration Service at the State Commands where the expatriate is resident accepting full Immigration Responsibilities

APPROVAL FOR EXPATRIATE QUOTAS

The Nigerian expatriate community is an ever-growing one that is guided strictly by immigration laws. A foreigner’s employability status in Nigeria as an expatriate is also dependent on an expatriate quota which the employer company must procure. Without the authorisation of the Nigerian Immigration Authorities, a foreigner cannot be employed. Section 34 (1) of the Immigration Act.

An expatriate quota is required by a Nigerian registered company before it can hire expatriates. It is a permit granted by the Ministry of Interior usually between two or three years and may be renewed upon expiry at the discretion of the Minister of Interior. However, it is non-renewable after ten years. There are two types of quotas namely, Permanent Until Reviewed Quota (PUR) and a Temporary Quota.

To also work and live in Nigeria, an expatriate must apply for and obtain a Residence Permit, which will enable him/her to remain in the country for a long period of time. In the event that a company only wishes to hire expatriates for a short period of time, a Temporary Work Permit will be issued.

For ECOWAS citizens, the rights and requirements greatly differ as they are free to enter, reside and establish businesses in any member State.

A company applying for an expatriate quota will be required to submit the following documents to the Ministry of Interior.

- Completed National Investment Promotion Commission (NIPC) form

- Copy of Certificate of Incorporation of the company

- Copy of Return of Allotment Form

- Copy of Particulars of Directors Form

- Copy of Memorandum & Articles of Association

- Proof of acquisition of business premises

- Tax Clearance Certificate

- Technical Service Agreement or Joint Service Agreement

- Feasibility Report

- NCDMB Approval for Oil Companies

- Certificate of Capital Importation

- Business Permit in the case that the applicant company is wholly owned by foreigners.

- Company profile

In the event that the application is for a Permanent Until Reviewed Quota (PUR), the following additional documents may be required;

- Company’s organizational structure

- Detailed audited accounts

- Individual income tax clearance of the expatriates,

- Monthly returns for expatriate quota if any; and

- Company’s tax clearance certificate.

Revocation of Expatriate Quota

According to Section 35 (1) of the Immigration Act CAP I1 LFN 2004, the Director of Immigration may, if he deems it to be in the public interest, at any time revoke a residence permit or other permit under this Act or may issue a new permit of such conditions as he thinks fit; and where any permit is revoked without replacement, the person affected shall be deemed to be a person seeking to enter Nigeria for the first time, and the Minister in his discretion, may issue a deportation order.

REGISTRATION WITH NIGERIAN INVESTMENT PROMOTION COMMISSION (NIPC)

Nigerian Investment Promotion Commission (NIPC) is a Federal Government agency established by the NIPC act to promote, coordinate and monitor all investments in Nigeria and as such, registration with the NIPC is crucial for all foreigners intending to do business in the country. As stated by the NIPC Act, within fourteen working days from the date of receipt of completed registration forms, the Commission will register the enterprise if it is satisfied with all relevant documents duly completed and submitted for registration or otherwise, advise the applicant accordingly.

An application for a business permit made to NIPC must be accompanied by the following:

- Completed NIPC form

- Copy of Certificate of Incorporation of the company

- Copy of Return of Allotment Form

- Copy of Particulars of Directors Form

- Copy of Memorandum & Articles of Association

- Proof of acquisition of business premises

- Tax Clearance Certificate

- Technical Service Agreement

- Feasibility Report.

TAXATION & TAX IDENTIFICATION NUMBER (TIN)

As a law-abiding citizen or resident of Nigeria, you are required by law to pay your tax. In order to fulfil your tax payment, you must undergo the necessary tax registration. Tax Administration is enforced by the three tiers of government and each tier presides over a designated jurisdiction for tax collection. Local councils manage the local government levies, the state taxes are managed by the Internal Revenue Board and the Federal Board of Inland Revenue (FBIR) manages federal taxes through the Federal Inland Revenue Service (FIRS). The various tax laws and treaties ensure the tax system works smoothly to avoid issues such as tax evasion, tax fraud and double taxation.

An expatriate will be liable to personal income tax in Nigeria if his employer has a fixed location for business operations in Nigeria, his employer is in Nigeria or present in Nigeria for 183 days in a year-long period. Where an expatriate is not liable to pay tax in a foreign country which has no double tax treaty with Nigeria, he/she is liable to pay tax in Nigeria.

Countries with which Nigeria has double tax treaties include:

- Canada

- Philippines

- Romania

- Czech republic

- Belgium

- Pakistan

- France

- The United Kingdom & Northern Ireland

Just like every legal structure, there are tax exemptions and incentives. Under various requirements, new or pioneer businesses receive what is known as a tax holiday. For pioneer businesses, tax relief of three years may be granted and may be renewed for another two years. Industrial Development (Income Tax Relief) Act, LFN, 2004. Tax exemptions and incentives cover specific goods, services and industries. All these are provided for in the Companies Income Tax Act 2004 (Now amended with the advent of the Finance Act 2020).

Tax Identification Number

The Tax Identification Number (TIN) refers to a unique number allocated and issued to identify individuals or companies as duly registered taxpayers in Nigeria. All registered businesses must obtain a TIN upon commencement of business because tax payments cannot be made without it. The TIN application is free, however, all requirements must be complied with.

For a company, the requirements for a TIN application include;

- An application letter on the company’s letterhead

- Duly completed TIN application form

- Photocopy of Certificate of Incorporation with original copy for validation only

- Photocopies of Particulars of Directors form and Return of Allotment form.

- Memorandum of Articles and Association

- Evidence of address of the place of business

In the case that the business is a sole proprietorship or partnership, the applicant must provide;

- An application letter on the company’s letterhead

- Duly completed TIN application form

- Photocopy of business name registration.

- Evidence of address of the place of business

REGISTRATION FOR EXPORT CERTIFICATES

Still considering the factors required to start a business in Nigeria, the nature of the business a foreigner intends to start will always come into play. In the event that the business operations involve the exportation of goods, an export certificate is required before starting such a business in Nigeria. The power to issue export certificates and licenses is/are vested in two government agencies, namely, the Nigerian Export Promotion Council (NEPC) which issues licenses for agricultural commodities and manufactured goods, and the Federal Ministry of Solid Minerals Development, which grants licenses for extraction and exportation in Nigeria.

APPROVAL FOR REQUISITE LICENSES

As a foreigner seeking to do business in Nigeria, it is important to understand that some businesses require special licensing and permits before operations can begin. In some businesses, foreigners have a certain level of participation for which licenses and permits may be granted under certain conditions. The following industries require approval for requisite licenses in order to operate in Nigeria.

-

Oil & Gas

The Oil and Gas industry is regulated by the Ministry of Petroleum Resources through the Department of Petroleum Resources (DPR). Companies with the intention to engage in oil and gas operations in Nigeria are required to register with the DPR. The company must be incorporated and the DPR is charged with processing all applications for the necessary licenses and leases in the industry.

-

Mining & Minerals

The Ministry of Solid Minerals oversees all mining and mineral(s) operations in Nigeria through four departments, namely, the Mines Inspectorate Departments, Mines Environmental & Compliance, Artisanal & Small Scale Mining Department and the Mining Cadastre Office. A foreigner who intends to run a mining and mineral company must procure the appropriate mining titles, licenses and permits from the (MCO).

-

Pharmaceuticals and Foods

The National Agency for Food and Drug Administration (NAFDAC) is a Federal Government Agency charged with the regulation and control of the importation, exportation, manufacturing, advertisement, distribution, sale and use of pharmaceuticals and food. These include cosmetics, medical devices, bottled water drugs, food, etc. All products in this category must be registered in accordance with the regulations of NAFDAC before it can enter the business cycle.

-

Power

Under the Federal Ministry of Power, the Nigerian Electricity Regulatory Commission (NERC) issues licenses to companies wishing to carry out electricity business in Nigeria and this includes Independent Power Producers (IPP). Various licenses are issued upon fulfilment of all necessary requirements.

-

Banking & Finance

The Central Bank of Nigeria (CBN) regulates the banking industry in Nigeria. No banking business can operate in Nigeria unless it is incorporated in Nigeria and holds a valid banking licence issued under the Banks and other Financial Institutions Act.

-

Telecommunications

All telecommunication service providers are required to apply and obtain requisite licenses and permits from the Nigerian Communications Commission (NCC). Licenses are granted by selection process, public tender, auction and competitive bidding and without it, a company cannot commence telecommunication business operations in Nigeria.

-

Aviation

The Nigerian Civil Aviation Industry is regulated by the Nigerian Civil Aviation Authority (NCAA). The agency is charged with the registration of aircraft in Nigeria and the issuance of a certificate of registration to its owners. Foreign registered aircraft need not procure NCAA licenses to operate in Nigeria’s airspace as their operations are dependent on the bilateral agreement between Nigeria and the country the aircraft has as its principal place of business.

-

Maritime & Shipping

The Nigerian Maritime Administration and Safety Agency (NIMASA) oversees the Nigerian maritime and shipping industry. The agency is charged with issuing ships licence and manages a registry of ships at its headquarters in Lagos. Persons eligible to own a Nigerian ship include Nigerian citizens, companies or partnerships or other persons the Minister may, by regulation, prescribe.

PROCUREMENT OF CERTIFICATE OF CAPITAL IMPORTATION.

Doing business as a foreigner in Nigeria comes with the likelihood of capital importation by any means and as such, a foreigner with the desire to import capital into Nigeria for business purposes will need to obtain a Certificate of Capital Importation (CCI). This document serves as evidence of importation of capital for investment in Nigeria. Capital could refer to machinery, foreign currency, raw materials, plant etc.

INTELLECTUAL PROPERTY

As a business operator in Nigeria, there are laws present to enforce intellectual property rights which protect intellectual property over a period of time. Intellectual property rights include:

-

Copyrights

Copyrights are protected for a lifetime and 70 years after the demise of the owner.

-

Patents

Patents are protected for 20 years.

-

Trademarks

Trademarks are subject to periodic renewal.

-

Designs

Designs rights are protected for 15 years.

LAND ACQUISITION

Being a factor of production as prescribed by economics, land is a crucial business resource. An immovable asset, land is an important resource of the nation-state which every person requires to do business directly or indirectly. A foreign investor may import labour and capital, however, he cannot import land.

In Nigeria, the Land Use Act governs land acquisition and use and today, the law confers all land in each state of the country on the State Governor, who is entrusted to operate to the benefit of the citizens. The Governor allows private persons and corporate bodies to occupy land for a term determined by the Governor, mostly not exceeding 99 years. Section 21 of the Land Use Act.

Till date, there are restrictions and regulations regarding land acquisition and use by foreigners which limits their rights to own property in Nigeria. These limitations differ from state to state in leasehold interest duration, grant of statutory right, customary right of occupancy and more. A foreigner can only be free from these limitations if he/she becomes a citizen of Nigeria either by registration or naturalization.

It is important to note that before acquiring property, proper research is required to ascertain the legitimacy of the transaction with regards to title documents, unpaid land charges, freedom from government acquisition etc.

LABOUR AND EMPLOYMENT LAWS

The establishment of businesses in Nigeria creates new avenues for labour to be employed and rightly so, there are governing labour and employment laws to aid it. Whether imported labour or local, there are guidelines that every operating business in Nigeria should be aware of. Like earlier outlined in this article, the law does not restrict the employment of expatriates as long as all necessary requirements are met. Some laws differ by industry, union and other laws provide exceptions to the rule i.e the Local Content Act enacted to enable indigenous skills in the oil and gas industry.

Other laws guiding labour and employment in Nigeria include:

- Labour Act

- Employee’s Compensation Act

- Factories Act

- Trade Unions

- Pension Act

- Trade Disputes

- Nigerian Social Insurance Trust Fund Act

- National Housing Fund Act

- National Health Insurance Scheme

- Nigeria Data Protection Regulation 2019 issued by the National Information Technology Development Agency

LEGAL REDRESS & FOREIGN JUDGMENTS

The role the law provides in the overall state of the country cannot be overemphasised. The legal system is set up in such a way that every person has a right to legal redress, be you a foreigner or a Nigerian citizen. It is not absurd for disputes to occur between a foreigner and a Nigerian party during the course of business and to this effect, commercial disputes can be settled in a Court of Law. A foreign company can sue or be sued in its name or in the name of its agent/representative. It is also important to note that a company need not be registered to sue or be sued. See Section 60 CAMA.

Court System

The Nigerian Courts have a hierarchy that comes with designated jurisdictions

- Supreme Court

- Court of Appeal

- High Court (Federal or State)

- National Industrial Court

- Sharia Court of Appeal

- Customary Court of Appeal

- Magistrate/District Courts

- Customary/Area/Sharia Courts

Enforcement of Foreign Judgment

Foreigners doing business in Nigeria brings foreign judgement into play by default. Following the influx of foreign investments in the country, the enforceability of foreign judgments and arbitral awards against a Nigerian company must be explored. A judgment from any jurisdiction is enforceable in Nigeria, however, we must note that the Nigerian Court is under no compulsion to enforce foreign judgments as Nigeria is not a party to any treaty or agreement in this regard.

The recognition of foreign judgments in Nigeria is guided by two statutes;

- The Foreign Judgment (Reciprocal Enforcement) Act CAP. F35, LFN 2004

- The Reciprocal Enforcement of Judgments Ordinance, CAP 175 Laws of the Federation & Lagos, 1958

A foreign judgment can only be enforced in Nigeria if it is registered, of which there are two procedures to recognise and enforce foreign judgements, namely; Under the Act and By Enforcement of Common Law. The conditions for which a foreign judgment can be registerable or recognized are provided for in the Foreign Judgement (Reciprocal Enforcement) Act of 2004 and the conditions for which a foreign judgment is not registerable is provided for in Section 3(2) & 6 of the Reciprocal Enforcement of Judgments Ordinance CAP 175 Laws of the Federation & Lagos, 1958.

Read our article to find out more on the Enforcement of Foreign Judgments

Foreign Arbitral Awards

Foreign Arbitral Awards can be enforced in Nigeria in five (5) ways:

- Under Section 51(1) ACA, 2004

- By an Action Under Common Law

- Under the New York Convention of 1958

- Under the International Centre for Settlement of Investment Disputes (Enforcement of Awards) Act, 2004

- Registration under the 1958 Ordinance and 2004 Act

The same way the Nigerian Courts can recognize and enforce a foreign arbitral award, so also can it be refused and set aside following the proof of the specified conditions.

CONCLUSION

The avenues to do business in Nigeria are endless and foreign investors can actively partake in profitable business, provided that all requirements are met and all procedures are duly followed. The legal framework and regulatory bodies are present to aid business operations, a guide and adequate information are all that is needed.

Leave a Reply